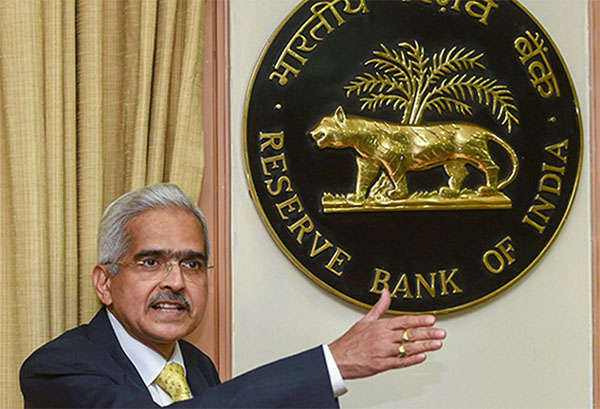

On Friday, at the press briefing post the monetary policy committee’s off-cycle meeting, which has been on for the past three days, Reserve Bank of India (RBI) governor Shaktikanta Das announced a 40 basis points (0.40%) cut in repo rate to 4 percent, with immediate effect.

The MPC voted 5-1 for a 40 bps repo rate cut. Reverse Repo has been adjusted to 3.35 percent from 3.75 percent.

The marginal standing facility (MSF) rate and the bank rate stand reduced to 4.25 percent from 4.65 percent.

In its address, Das said that “the global economy is inexorably headed into a recession.” He also said that while volatility in global markets may have ebbed “but markets have generally been disconnected from developments in the real economy.”

Speaking on the condition of the economy, the governor said that there has been a collapse in demand in both urban and rural demand since March 2020. The biggest blow was to the private consumption slump with consumer durables production falling 33 percent.

However, agriculture and allied activities have given a beacon of hope for the country, he said.

The MPC also decided to continue with the accommodative stance as long as it is necessary to revive growth and mitigate the impact of COVID-19 on the economy while ensuring that inflation remains within the target. The medium-term target for consumer price index (CPI) inflation stood at 4 percent.

This the central bank third such press briefing since the nationwide lockdown began to contain the spread of the pandemic.

In his previous addresses post the COIVD-19 outbreak and lockdown, the RBI governor had announced a series of measures to infuse liquidity into the banking system and support the economy on 27 March and 17 April.